Financing Exports With Accounts Receivable

Accounts Receivable Factoring provides an easy solution for companies that need immediate liquidity because it creates an immediate influx of cash from the invoices already on your books.

Export Accounts Receivable Factoring Summary:

Records of sales Factoring administrations that convey quick liquidity for your business. This is a definitive commodity supporting arrangement. We give Accounts Receivable Factoring administrations to exporters that element or sell their unfamiliar records receivable. The records receivable are sold at a rebate yet they are likewise sold without response, and that implies you have no proceeding with obligation or openness of any sort. That is unbelievable true serenity for entrepreneurs.

Calculating records receivable is an ideal answer for independent ventures who are trading abroad and offering funding terms to your unfamiliar purchasers. We give you a prompt inundation of money from the solicitations that are now on your books or which will be made upon the commodity of products to your unfamiliar purchaser. You access cash promptly without hanging tight for installment from abroad purchasers and with no openness to installment default. You’re settled completely and chipping away at your next bargain.

We offer records receivable calculating depending on the situation or on a proceeding with premise. Figuring money due gives organizations the capacity to offer terms to worldwide clients yet get cash when the merchandise are conveyed. We are quick, definitive and will give the funding your business needs, typically in somewhere around ten days on the off chance that we haven’t carried on with work previously. We’re a lot quicker in the event that we have a laid out relationship, where we can frequently give the liquidity you really want in 48 hours or less. Demand Accounts Receivable Factoring at present.

Accounts Receivable Factoring

Considering records of sales is a typical strategy for send out supporting that gives exporters liquidity by figuring or selling their records receivable. The records receivable are sold at a rebate however they are likewise sold without response. Calculating records receivable is an ideal answer for organizations that need additional money for stock, finance or advertising since it makes a quick convergence of money from the solicitations currently on your books. Organizations can get to speedy money from their solicitations to begin their next project. Calculating records receivable can be used depending on the situation or on a proceeding with premise. Calculating records receivable gives organizations the capacity to offer terms to global clients yet at the same time get cash when the products are conveyed.

Customary considering is an ideal answer for organizations that need additional income to buy stock, cover finance or put resources into promoting. You can make a quick flood of money in light of the solicitations currently on your books. The money supplier, known as the element buys each of your records receivables and advances you 70% to 90% of the aggregate sum inside 24 to 48 hours. The component pays you the rest of what you’re owed once your client pays the variable, generally 30 to 45 days after the fact. It deducts a little expense, in light of the size and age of each receipt.

Money due Factoring, which is known by a few names, is regularly called debt claims figuring, receipt considering, and now and then records of sales funding, in spite of the fact that debt claims supporting is a term all the more precisely used to depict a type of resource based loaning against records of sales.

Debt claims Factoring is a monetary exchange that is a typical technique for exchange finance that gives quick liquidity to organizations that sell their records receivable at a markdown. Albeit the rebate in the presumptive worth of the records receivable is an expense, organizations benefit in changing over their records receivable to prompt money, and their records receivable are ordinarily sold without response.

Figuring is much of the time an ideal answer for organizations that need additional money for stock, finance or showcasing in light of the fact that it gives quick money dependent exclusively upon solicitations currently on their books, so it requires no getting. Organizations can get to fast money from their solicitations to begin their next project. Money due Factoring can be used depending on the situation or on a proceeding with premise.

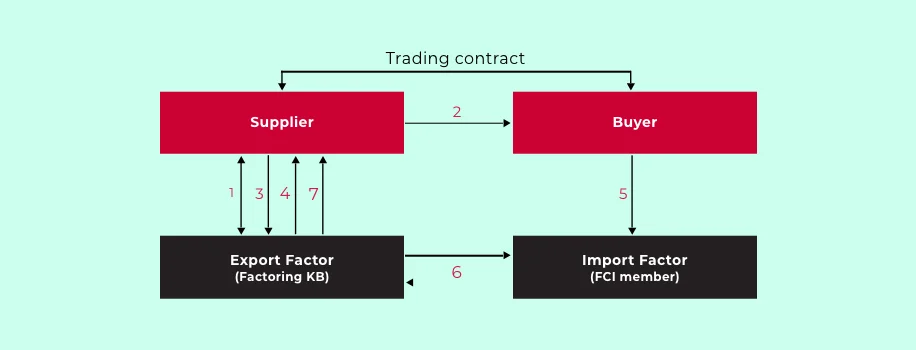

In the realm of worldwide exchange finance, Accounts Receivable Factoring can be a huge benefit to organizations who use calculating as an exchange subsidizing strategy to put themselves a situation to offer credit terms to global clients in send out finance exchanges while as yet getting cash when the products they are trading are delivered. The contribution of credit terms to clients can be an enormous upper hand.

Customary Accounts Receivable Factoring is an ideal answer for organizations that need additional income to buy stock, cover finance, put resources into promoting, or basically any utilization of quick liquidity. Organizations that factor their records receivable make a prompt convergence of money dependent completely upon solicitations which are as of now on their books. In a normal Accounts Receivable Factoring exchange, the money supplier, who is known as the element, buys the records receivables and advances 70% to 90% of the aggregate sum to the organization in 24 to 48 hours. The component then, at that point, pays the rest of what is owed to the organization once the client pays the element for the remarkable solicitations, which is normally 30 to 45 days after the fact.

Figuring isn’t equivalent to receipt limiting which is called an “Task of Accounts Receivable” in American bookkeeping, as proliferated by FASB inside GAAP. Calculating is the offer of receivables, though receipt limiting (in fact “task of records receivable” in American bookkeeping) is acquiring that includes the utilization of the records receivable resources as security for the credit.

Best Way to Accounts Receivable Factoring

An element is a monetary mediator that buys receivables from an organization. An element is basically a source of financial support that consents to pay the organization the worth of the receipt less a rebate for commission and expenses. The component propels the vast majority of the invoiced sum to the organization right away and the equilibrium upon receipt of assets from the invoiced party.

A component permits a business to get prompt capital in light representing things to come pay credited to a specific sum due on a record receivable or business receipt. Money due capability as a record of the credit reached out to one more party where installment is still due. Considering permits other closely involved individuals to buy the assets due at a limited cost in return for giving money front and center.

The agreements set out by a component might fluctuate relying upon their own inward practices. Most ordinarily, considering is performed through outsider monetary establishments, alluded to as variables. Factors frequently discharge reserves related with recently bought records of sales in 24 hours or less. Reimbursement terms can differ long contingent upon the sum in question. Moreover, the level of assets accommodated the specific record receivables, alluded to as the development rate, can likewise shift.

Calculating isn’t viewed as a credit on the grounds that the gatherings don’t issue or secure obligation as a component of the exchange. The assets gave to the organization in return for the records receivable is additionally not expose to any limitations with respect to utilize.

Let’s Understanding Accounts Receivable Factoring

A component is a monetary middle person that buys receivables from an organization. The component is basically a lender and money source that consents to pay the organization the worth of their solicitations less a rebate for commission and charges. The variable advances the majority of the invoiced sum to the organization right away, with the equilibrium endless supply of assets from the invoiced party.

Calculating assists a business with getting quick capital in light representing things to come pay credited to a specific sum due on a record receivable or business receipt. Debt claims capability as a record of the credit stretched out to one more party where installment is still due. Figuring permits other closely involved individuals to buy the assets due at a limited cost in return for giving money front and center.

The agreements set out by a component might differ relying upon their own inward practices. Most ordinarily, records of sales considering is performed by outsider agents who are known as elements. Factors frequently discharge reserves related with recently bought records of sales in 24 hours or less. Reimbursement terms can shift long contingent upon the sum in question.

Moreover, the level of assets accommodated the specific record receivables, alluded to as the development rate, can likewise differ. Records of sales figuring isn’t viewed as a credit in light of the fact that the gatherings don’t issue or procure obligation as a component of the exchange. The assets gave to the organization in return for the records receivable is likewise not expose to any limitations in regards to utilize.